Press Releases

Lesaka’s Q2 FY2026 Results: Lesaka achieves the mid-point of its profitability guidance and reaffirms its FY2026 full year guidance

05 Feb 2026

By Lesaka

JOHANNESBURG, February 5, 2026 – Lesaka Technologies, Inc. (Nasdaq: LSAK; JSE: LSK) released results for the second quarter of fiscal 2026 (“Q2 2026”).

Commenting on the results, Lesaka Chairman Ali Mazanderani said, “I am delighted that for the first time since the creation of Lesaka in 2022, we have delivered a positive Net Income and have met our guidance for the 14th consecutive quarter. We also reaffirm our full-year guidance for FY2026, which will represent a 49% growth in Group Adjusted EBITDA at the mid-point, and positive Net Income attributable to Lesaka.”

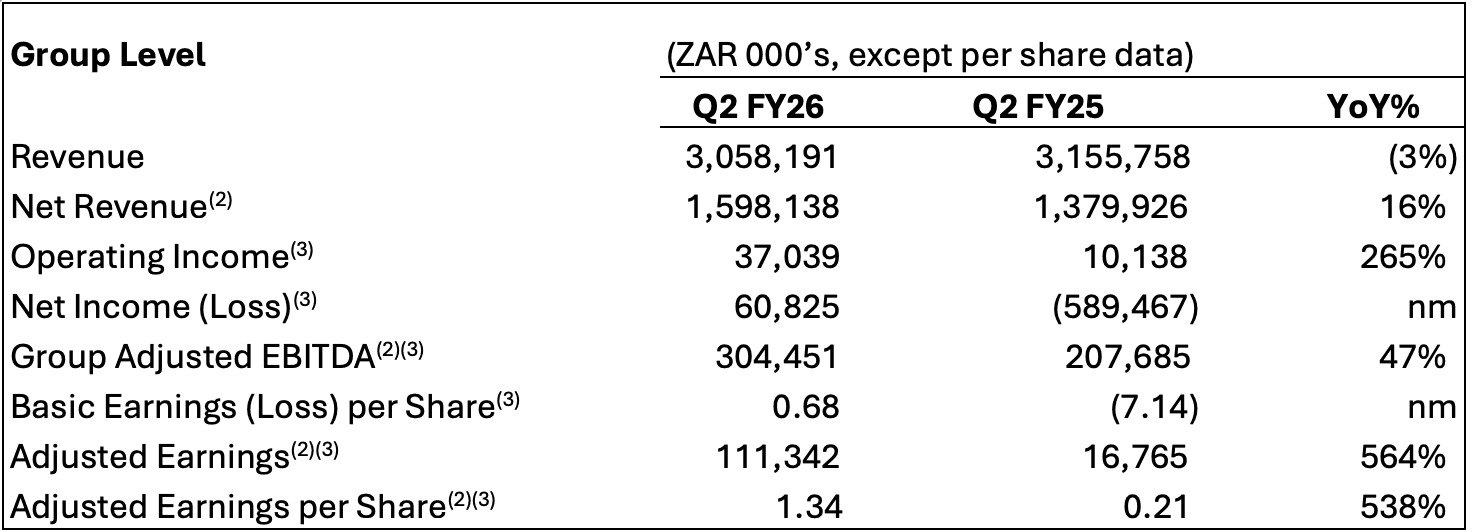

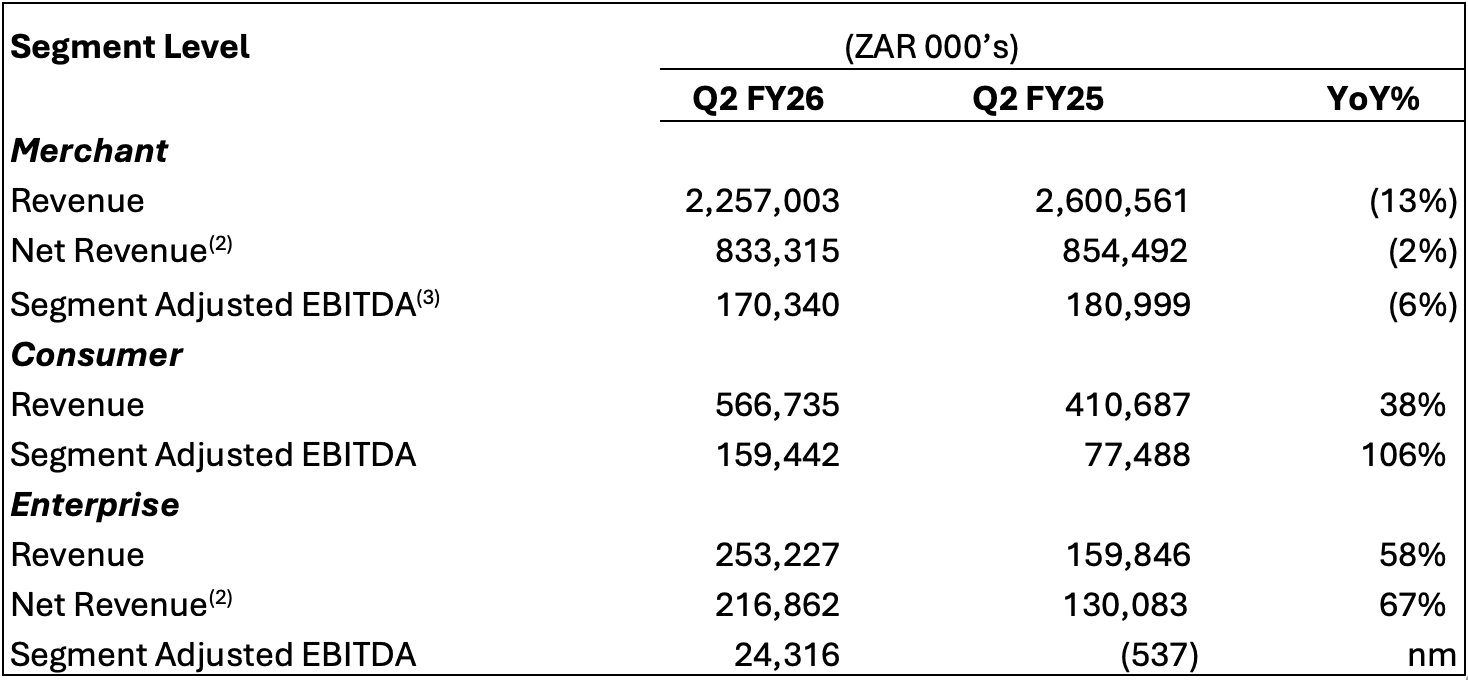

Q2 2026 performance1:

All growth rates are year-on-year between Q2 FY2026 and Q2 FY2025.

Average exchange rates applicable for the purpose of translating our results of operations: ZAR 16.96 to $1 for Q2 2026, ZAR 17.85 to $1 for Q2 2025.

Non-GAAP measure. Refer to Attachment A of this release for full reconciliation of non-GAAP measures.

Revised to correct the errors discussed in Note 1 of our Form 10-Q for the period ended December 31, 2025.

Outlook: Third Quarter 2026 (“Q3 FY2026”) and Full Fiscal Year 2026 (“FY 2026”) guidance

While we report our financial results in USD, we measure our operating performance in ZAR; accordingly, we provide our guidance in ZAR.

For Q3 FY2026, the quarter ending March 31, 2026, we expect:

Net Revenue between ZAR 1.65 billion and ZAR 1.80 billion.

Group Adjusted EBITDA between ZAR 300 million and ZAR 340 million.

For FY2026, the year ending June 30, 2026, we reaffirm:

Net Revenue between ZAR 6.4 billion and ZAR 6.9 billion.

Group Adjusted EBITDA between ZAR 1.25 billion and ZAR 1.45 billion.

Net Income Attributable to Lesaka to be positive.

Adjusted earnings per share of at least ZAR 4.60, implying a year-on-year growth of greater than 100%.

Our FY2026 guidance excludes the impact of the announced acquisition of Bank Zero (which is subject to regulatory approvals and other customary closing conditions) and any unannounced mergers and acquisitions that we may conclude.

Management has provided its outlook regarding Net Revenue, Group Adjusted EBITDA and Adjusted earnings per share, which are non-GAAP financial measures and excludes certain revenue and charges. Management has not reconciled these non-GAAP financial measures to the corresponding GAAP financial measures because guidance for the various reconciling items is not provided. Management is unable to provide guidance for these reconciling items because they cannot determine their probable significance, as certain items are outside of the control of Lesaka and cannot be reasonably predicted since these items could vary significantly from period to period. Accordingly, reconciliations to the corresponding GAAP financial measure are not available without unreasonable effort.